Boring Trading Routine

"Trading must be exciting!"

When pushed further, this person thought that you pushed a few buttons and simply closed trades while adding money to your account. Sounds like someone was caught up in the ATM description often used to describe the newest trading system.

Then again, thinking back to the early days and my trading start, it was a little exciting. The trade was entered and I watched the bars float back and forth between profit and under water.

When the trade hit the profit target, it really was exciting. I remember yelling for my wife to check out the great work I had done!

Losers? They were another story.

I used to think I did something wrong and would spend far too much time go over the setup and execution even though it matched the trade plan that had been tested.

I didn't realize the cold hard truth about trading and the wins and losses that come. By themselves, they are meaningless. As a whole, there is meaning.

Trading Is Routine

Jumping ahead for a moment, proper trading requires a set of rules that dictate whether or not you will be in the market. Not only that, when a setup occurs, you simply wait for a trigger...assuming you actually have a trigger....and then wait for the trade to progress.

Here is an example of waiting in trading and you will see, there is nothing exciting about it.

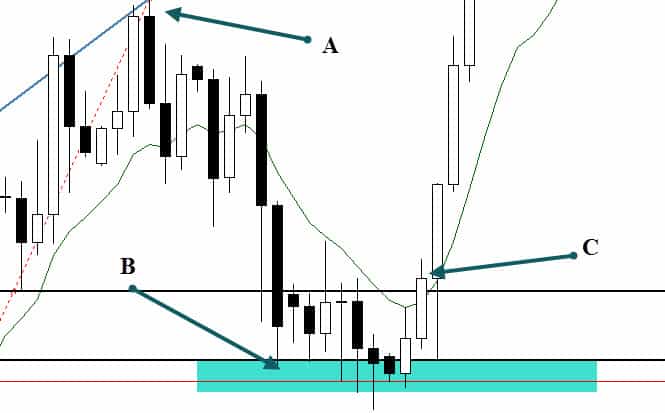

A. Price makes a high and allows the drawing of Fibonacci retracements

B. Is an area where there is a retracement plus symmetry from a prior swing

C. Price breaks the trigger line and you buy stop the high of the candle

Eight full days elapse before price even touches our zone of interest. It takes 9 more days for the trade to give us an entry.

Yes, this is a swing trade but it equally applies to a day trading scenario.

- Zone of interest

- Wait for price to reach it

- Wait for the trigger

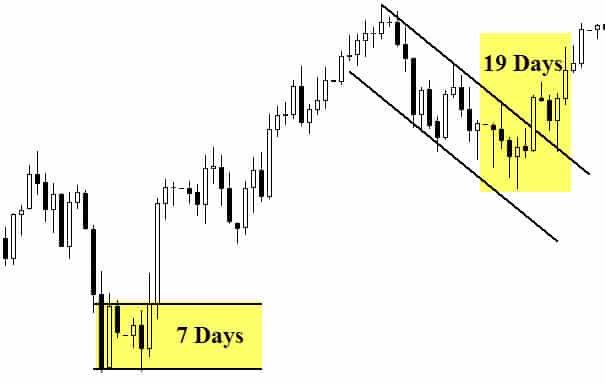

Trading patterns can also be non-exciting.

Waiting for the pattern to form (close is close enough of course) and then a resolution of the pattern can take a while to occur such as the ones seen in this chart.

Exciting? Not really.

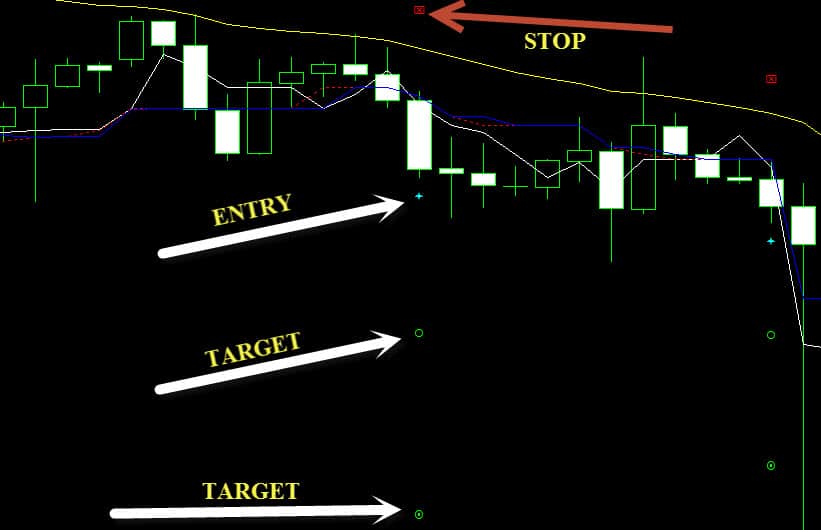

Taking a look at trading systems offered to you by Netpicks for example, you have printed on the charts your entry, targets, and a stop loss.

Between this setup and the previous you can't see, it took 5 days on this four hour chart to pass before you had another setup.

Side note: There is a further target off the chart that was hit for 502 pips 8 days later on this setup

So I have pointed out that waiting for the setup and trigger certainly does not fit into the "exciting" category. Every day you scan for the setups or potential setups....and wait.

You scan for the same things. You take the same action. You book wins and book losers.

Let's go back to trades in progress and see if those are exciting or are simply part of the boring trading routine.

Exciting Wins. Disappointing Losers.

My early years were an example of what not to do.

My early years were an example of what not to do.

Excitement for wins. Frustration for losers.

Don't put any weight into any one trade. If we are trading a system with an edge, we know we will win and we know we will lose.

Each win/loss comes up in a random distribution of the efficiency of the trading system.

- A win today does not change the fact that a loss is inevitable.

- A loss today does not change the fact that a win will eventually show up.

Why?

Because the trading system has an edge (hopefully you have tested this). Inside of that edge you remain unattached to the outcome of each trade.

Changing the thought process no longer makes watching the flashing lights an exciting event. It actually can cause more harm than good if you decide to take action outside of your trade plan.

It may be a little difficult for many that day trade depending on their method of trading. If using a system that plots out targets and stops, you enter the numbers into your platform and wait.

However if you rely on price structure/patterns/action, you have to be aware of what the price is doing but you should know what requires action and what doesn't at a glance.

Many of the top traders will tell you that if you that the results of trading can be exciting.....but not the actual act. The actual act is routine and sometimes the boredom that results can cause less experienced traders to force something that isn't there.

Be bored. Your trading may improve.