Increase your odds of Success with Options Trading

Has the market left you shaking your head the last few weeks?

We haven't seen much volatility the last few years as central banks have been on an orchestrated mission to prop up global markets at all costs. As a result we have been in a one way, low volume grind to the upside for years now.

This market changed a few weeks back when we finally saw sellers wake up from hibernation. Since that time we have seen some historic moves back and forth with expanding ranges intra-day.

This can lead to very frustrating trading conditions if you aren't able to track the markets all day long.

If you blink in this market you are potentially missing out on hundreds of points.

While this is a great environment for day traders, what does this mean for swing traders like me who like to be in positions for days or weeks?

Let me walk you through some of the things I have been doing lately to grind out some profits.

My Options Trading Breakdown

Most traders are programmed early on that the only way to make money is to pick market direction and then hope for the best. In the options trading world this means many are buying long calls and long puts or vertical spreads.

What's the problem with that?

With this approach is that you not only need to be right on market direction but you need to be right on the amount of time that move will take. When you buy option premium time is working against you. In periods of high volatility we actually like to take the other side. We like to put time decay in our favor by selling options.

One of the trades that we put on back in August was on Apple (symbol: AAPL).

AAPL is one of the most popular stocks out there for many traders and as a result is a very liquid product. Instead of buying long calls or long puts to play market direction, we decided to put on an options trade that would profit if AAPL stayed inside of a price range or a 'profit window' as we like to call it at NetPicks.

We opened up an AAPL position by selling an Iron Condor in the weekly options. While the name sounds confusing it is actually a very simple position to put on. An Iron Condor is put on by selling an out of the money call spread and out of the money put spread at the same time.

AAPL Options Trade Details

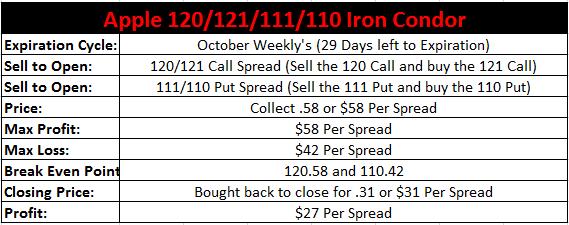

At the time of this trade we didn't really have a strong directional opinion on AAPL. We knew they had a new product release coming up in September which can cause some choppiness. So we decided to open the trade out in the weekly options with 29 days left to expiration.

We sold the 120/121 call spread and at the same time sold the 111/110 put spread.

On the call side this meant we were selling the 120 call and at the same time we bought the 121 call to make it a hedged position.

On the put side we sold the 111 put and bought the 110 put to make it a hedged position.

All together we sold the position for $0.58. This meant we collected $58 per spread to put the trade on.

The goal of this trade is to close it out by buying it back for a cheaper price.

Our 'profit window' is the area that we want AAPL to stay inside and that is defined by our short strikes (plus the amount of premium collected for placing the trade factored in).

So in our trade we sold the 120 call and the 111 put. We collected $.58 to put the trade on so we are going to add that to the 120 call strike price to give us a break even point on the upside of 120.58.

We sold the 111 strike put option so we are going to subtract $.58 from that price to get our break-even point of 110.42 on the downside.

Our profit window that we want AAPL to stay inside is 120.58 and 110.42.

Instead of picking whether AAPL is going higher or lower we are now giving ourselves the chance to make money if AAPL goes higher, lower, or sideways as long as it stays inside of our profit window.

Our AAPL Options Trade Goal?

The goal of this trade is to close it out by buying it back cheaper down the road.

- We know options lose value over time the longer they are held so we can profit on this trade from time decay adding up.

- We also know options get cheaper when volatility decreases.

At the time of this trade we felt volatility was high, so we were betting on the options getting cheaper by volatility decreasing. As mentioned above we also had the chance to make money in all 3 potential market moves.

So why wouldn't we put this trade on every time?

Seems too good to be true right?

Potential Risks

When we put on an Iron Condor the most we can make on the trade is whatever we collect for selling the trade. In the case of our AAPL trade this was $58 per spread. The most we can lose on this trade is $42 per trade (calculated by taking the difference between the strikes minus the credit received for placing the trade).

So we have just over a 1:1 reward to risk ratio.

While this might not seem great to some people, the trade off is that we have so many ways of being profitable on the position as we outlined earlier.

The danger on this trade is when AAPL pops outside of our profit window. When this happens we will start to lose money.

IMPORTANT: This is a fully hedged position so even if AAPL pops outside of our profit window we can't ever lose more than the $42 maximum loss.

Now let's get back to how our trade played out.

While we put the trade on expecting AAPL to stay inside of a tight range, the exact opposite happened. The bottom decided to fall out of the market and we saw AAPL make a big move lower.

For a stretch of days, we actually fell outside of our profit window. The nice part about selling an Iron Condor is that we are putting time decay in our favor. We don't have to feel rushed to get out of the trade. So when we popped outside of the profit window, I told my students that I was holding the trade expecting it to bounce higher.

Well what do you know, that is exactly what happened. AAPL bounced back higher right back into our profit window.

As a result of being patient, we went from a losing position right back into a profitable trade. We ended up closing out of the trade by buying the trade back for $.31 giving us a profit of $.27 or $27 per spread.

Doesn't seem that impressive at first glance right?

Remember we were completely wrong on market direction and still made money! We actually made close to 50% on the trade to be exact in less than 20 days holding the trade. We survived the crazy market volatility and still made money when the market did exact opposite of what we wanted it to do.

These are the types of trades that can be so powerful for options traders because we are not forced to wait for one type of market to make money.

There are strategies that can be profitable regardless of what the market does. You can't say that about any other market out there.

Take the time to expand your options playbook so next time the market throws us a curve-ball we can go back to our playbook and know exactly what to do.

Don't get caught on the sidelines waiting for the next trend move. Iron Condors can produce profits in periods of chop and uncertainty.

In my opinion this will become a key trade type as we head into the end of 2015 as we get back into a two way market instead of the one way grind higher that we have seen the last few years.