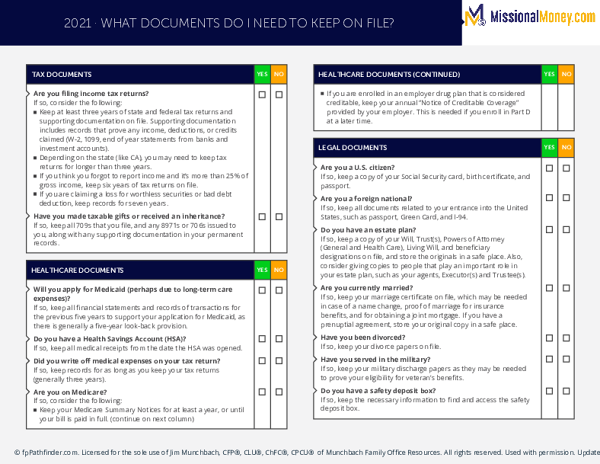

Documents To Keep On File

Documents that you need to consider keeping in case you encounter any number of issues.You are often confused as to what documents to keep in your files. Records relating to tax and legal matters, healthcare issues, assets and liabilities, as well as other important transactions should be kept in case they are needed in the future.In this checklist, we cover a number of documents that you need to consider keeping in case you encounter any number of issues, including:-Various tax documents, including past tax returns as well as documents related to specific transactions, such as annual gifts made to children, relatives, or others. -Healthcare records, including those relating to Medicare eligibility, substantiating medical deductions on prior tax returns, and confirming any contributions to, and distributions from, a health savings account (HSA). -Various legal documents, including proof of your citizenship or military service, estate planning instruments(e.g. Will, Trust, and Powers of Attorney.), and records surrounding your marriage or your divorce. -Documentation regarding certain assets owned and debts incurred by you, including statements and disclosures for investment accounts and employer-sponsored retirement accounts, business records (e.g. the company EIN and documents of formation and operation), student loan and mortgage statements, and titles to automobiles and real estate, among others. -Other types of documents such as copies of any insurance policies and relevant paperwork, employment contracts, and proof of professional certifications that you may hold. This is a comprehensive checklist of the types of documents that you need to consider retaining in your files.Updated for 11/15/2020